From Nike to Zara, NYC shopping has never been better

January 19

The imminent ascendance of New York real estate titan Donald Trump to the White House hasn’t just boosted the stock market. It also opened the deal-making floodgates as certainty returned to the city’s retail marketplace.

“It’s Trump-enomics,” says Faith Hope Consolo, chairman of Douglas Elliman Retail. “Most companies, whether foreign or local, are going forward [to sign leases] — and that was from the day after the election. I got this flurry of interest.”

It’s not just due to a new president. Over the last several months, building owners have become more flexible with leasing terms because there are fewer tenants in the market, in part because a strong dollar has dampened foreigners’ shopping at area retailers.

Concessions by owners have led to more deals — including one of the world’s most expensive, which was also the largest retail deal in 2016: At the end of November, Nike agreed to pay $700 million in rent over the next 15 years for over 69,214 square feet on seven floors at 650 Fifth Ave.

It sits at the corner of 52nd Street, owned by Jeff Sutton of Wharton Properties and SL Green Realty Corp., and includes 100 feet of frontage.

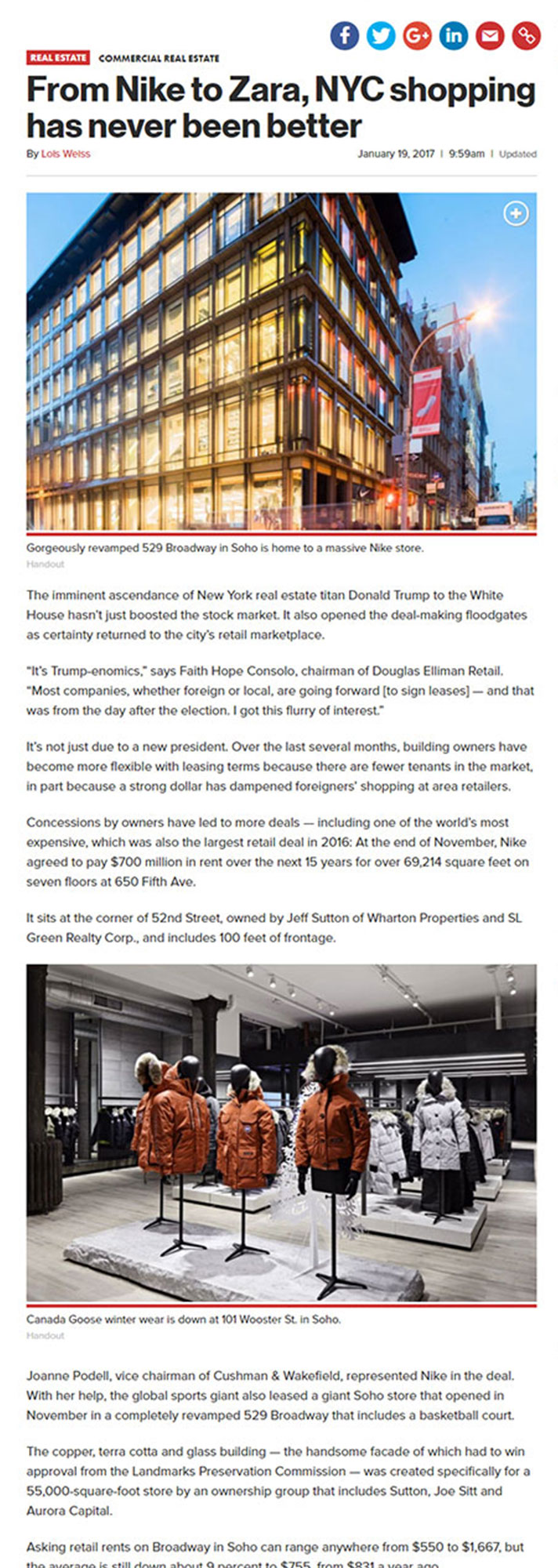

Joanne Podell, vice chairman of Cushman & Wakefield, represented Nike in the deal. With her help, the global sports giant also leased a giant Soho store that opened in November in a completely revamped 529 Broadway that includes a basketball court.

The copper, terra cotta and glass building — the handsome facade of which had to win approval from the Landmarks Preservation Commission — was created specifically for a 55,000-square-foot store by an ownership group that includes Sutton, Joe Sitt and Aurora Capital.

Asking retail rents on Broadway in Soho can range anywhere from $550 to $1,667, but the average is still down about 9 percent to $755, from $831 a year ago.

Despite the decline, Broadway is still expensive enough for retailers to open on other Soho streets, notes Podell.

In the hectic month of November, for instance, celebrity-beloved outerwear brand Canada Goose debuted its shop at 101 Wooster St. The space, which had an asking rent of $550 per foot, counts Chanel and Tiffany as neighbors.

Robert Cohen of RKF represented Canada Goose in the transaction with owner Sutton.

Sutton, a creative retail investor, also signed a deal with Skechers for 2,300 feet at 530 Broadway, right across from competitor Nike — at a rent that may have topped $1,000 per foot.

“Street retail in the major cities — New York, Chicago, Miami — is where people want to be,” says Richard Hodos, vice chairman of CBRE. “It’s the old ‘town center’ of every town you want to be in.”

Podell, who declined to comment specifically on the Nike deals, says there are always a range of sizes, shapes, corners and floors available for store-seekers in New York — but that some locations are simply better than others and worth every buck.

The recent fall Real Estate Board of New York (REBNY) retail report, for instance, pegged the highest-priced area in the city as Fifth Avenue from 49th to 59th streets, with average asking rents of $3,500 per foot.

In that area, Matthew Seigel of Thor Retail Advisors represented Dyson, which leased what will become a futuristic home-appliance showroom next to Victoria’s Secret at 640 Fifth Ave. The space had an asking rent of $3,250 per foot.

Sutton and Sandeep Mathrani of General Growth Properties were even able to pull in $5,500 per foot from Bulgari for their corner lease at 730 Fifth Ave. at 57th Street.

“Don’t you pay up to have the best location in the world?” Podell asks. “We all agree there a considerable number of availabilities, but there are still neighborhoods that are terrific.”

Add the Financial District to that list. With the Westfield World Trade Center mall open — which has underground links to both the Brookfield Place shopping and office complex, and the Fulton Center retail and transit hub, food and luxury retailers are doing well downtown.

The nearby Broadway corridor between City Hall and Battery Park has few available spaces. REBNY found rents in the area have leaped 20 percent over the last year — from $308 per foot last fall to the current $369 per foot.

The Japanese fast-fashion pioneer Uniqlo, for one, is reported to be negotiating for 100,000 square feet at 23 Wall St., which is in contract to Jack Terzi of JTRE, who declined to comment.

“This is the most vibrant submarket in terms of leasing activity,” says Alan Schmerzler, vice chairman at Cushman & Wakefield. He cites a nearby example: “Zara is blowing the doors off its sales projections at 222 Broadway.”

Cushman & Wakefield is marketing the remaining corner of 195 Broadway, at Dey Street, with 4,800 square feet on the street and 5,096 feet on a lower floor that has 17-foot ceilings. That prime spot is next to Nobu, the iconic Japanese restaurant that is relocating from Tribeca to the Financial District this year. Plus, Anthropologie is the main tenant in the base.

Marshall’s also signed downtown’s largest retail deal of 2016 with 66,000 square feet on three levels at 140 West St.

Another FiDi opportunity is the 113,000 square feet available through RKF at the base of Harry Macklowe’s One Wall Street.

RKF is also the consultant to Howard Hughes Corporation on its redevelopment of the South Street Seaport. RKF executive vice president Joshua Strauss declares that pocket will be “the sleeper hit of downtown.”

Up in Midtown, Strauss adds, Times Square has become a retail hot spot that “under-promises and over-delivers.” He is representing 50,000 square feet at the base of 11 Times Square — on the southwest corner of Eighth Avenue and West 42nd Street. Several entertainment companies are seeking spots in the Times Square area.

“The widening of pedestrian plazas has impacted not just the footfall but the time people spend in the area,” says Steven Soutendijk, executive managing director of Cushman & Wakefield. “We were wary of the construction and the effects, but there is no question — even by the most skeptical — that it’s been a net positive for Times Square.”

A store’s exact location, along with foot traffic and shopping hours, enter into any leasing decision. Retailers had been holding off on signing some deals and worrying about overpaying rents.

And owners have reacted. Rents in some areas — like in Greenwich Village — are now more affordable.

“Bleecker Street’s rent came down dramatically and is now in the $300s per foot. At one point, it was almost in the $800s,” says Elliman’s Consolo. “I feel the landlords are being more reasonable because they’re heading into a more positive time.”

Building owners are also more willing to do physical work and offer longer free rent, says Michael O’Neill, executive director of Cushman & Wakefield.

With more flexibility being shown by owners, retailers that had been in holding patterns are now feeling the urgency to land.

“We are seeing tenants that have been looking at the market for two or three years finally making deals,” observes Robin Abrams, vice chairman at The Lansco Corporation.

“Over the last couple of months, new and old brands have been starting to kick tires again,” Strauss agrees.

Adds Kim Mogull, CEO of Mogull Realty, “Now that the election has passed, the business mood has gone from hesitant to confident.”